This insight was originally published as a guest article in Private Equity Wire. Click here to view

We previously looked at how alternative data sets, having become ubiquitous within the hedge fund industry, are of increasing interest in the private equity asset class as well. Just as their hedge fund counterparts now routinely sift through satellite imagery or web traffic data to inform their investment strategies, private equity managers can gain an edge in investment origination and value creation by making use of non-traditional sources of information.

However, the disconnect between the enhanced returns on offer to private equity firms from alternative data and its relatively limited adoption across the industry to date speaks to the complex technical and regulatory challenges that it poses.

Assembling the informational jigsaw

It bears repeating that insights gleaned from alternative data should never be the sole factor on which an investment manager makes any decision. Instead, they are one piece of a bigger informational jigsaw. In the case of a private equity firm, perhaps the most obvious ‘traditional’ data source is its in-house portfolio monitoring system, through which it tracks a range of financial and operational metrics produced by each of its investee companies.

It is an inescapable conclusion that a shortage of technical and regulatory know-how is the principal barrier to managers adding this new string to their analytical bow.

The combination of this internal data, which is proprietary to the GP in its role as shareholder in a private company, and external data on wider societal, industry, or consumer trends can inspire new strategic ideas, provide a full ‘360-degree view’ of portfolio company health, or help more accurately chart a business’s future growth trajectory. One illustrative example might be a PE firm that owns an online travel agent looking at search engine metadata, alongside the company’s own website analytics, to track the rebound in consumer sentiment towards air travel post-pandemic.

The obvious technical challenge that this presents is how to best integrate these internal and external data sets into one coherent system where the data is consistently formatted and made available to the different teams that need access. Private equity firms often lag significantly behind the bigger indexing giants and other, more quantitatively driven asset managers in the sophistication of their technology ecosystems. Many only find themselves now in the early stages of moving away from more manual and spreadsheet-based processes for managing their different internal data sets (which, alongside portfolio company data, includes their CRM database on their investors and their fund accounting systems). The danger of running before they can walk is very real.

An additional challenge is the inherently more unstructured nature of alternative data compared to its traditional financial equivalent. Much more work is required to clean and extract value from alternative data, necessitating the kind of big data and machine learning expertise that significantly exceeds what’s covered in industry-standard financial modelling training.

Much more work is required to clean and extract value from alternative data, necessitating the kind of big data and machine learning expertise that significantly exceeds what’s covered in industry-standard financial modelling training.

Identifying the technical solutions

An alternative to building in-house data science expertise is for PE firms to buy off-the-shelf, pre-scrubbed and standardized data from the third-party vendors that have emerged over the past decade to service hedge funds. However, there are nuanced differences in what private equity and hedge fund managers are typically seeking from these data sets. The former often prefer smaller subsets that apply to the specific situation of a particular portfolio company; the latter have a natural inclination towards more expansive datasets that might throw up a range of more speculative investment opportunities across different markets and asset classes globally. Inevitably data vendors are becoming more flexible in response to the market opportunity presented by private equity and their evolving demands, but this remains an ongoing and relatively early-stage process.

The ideal end state for a PE firm is to deploy analytical solutions that are designed for specific data types and sources and customize these so that they can interface with and provide data inputs to each other, with the final outputs collated on a single dashboard. This serves to abolish the silos that exist between different data sets and allows the GP to aggregate as much data as possible, analyze it internally to make better-informed investment or portfolio management decisions, and report it externally, where required.

If data vendors, technology providers, and fintech consultants can service this growing demand, we should expect to see a pronounced change in how the private equity industry makes its investment, portfolio management, and exit decisions.

In the longer term, developing machine learning, big data, and process automation capabilities in-house will allow PE firms to continuously broaden their horizons of data analysis and integrate emerging data sets into a heavily automated, low-touch investment analysis process.

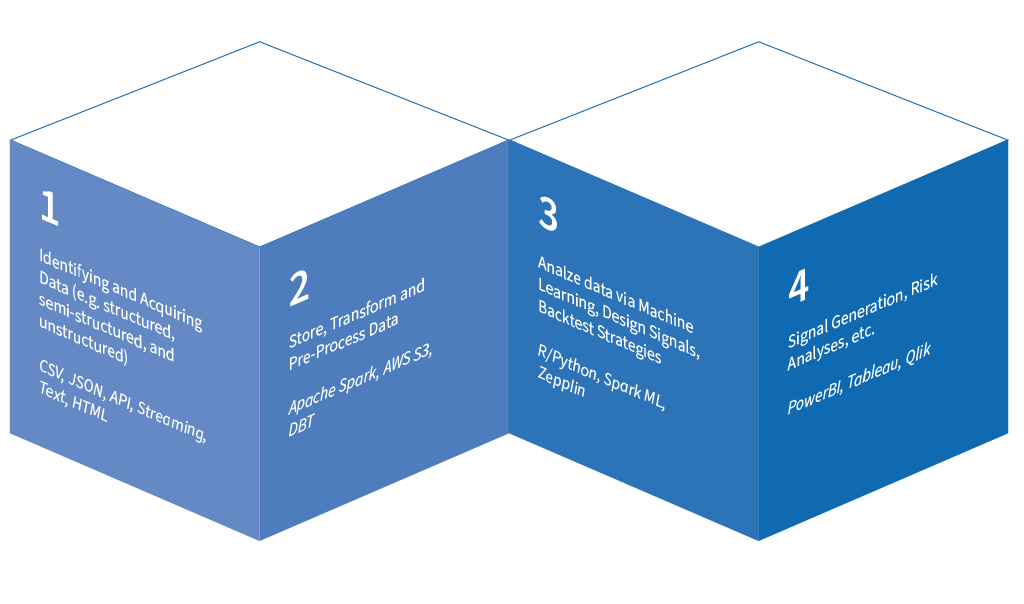

Below is an illustrative Analytics Architecture depicting data workflow and sample technology stack.

Navigating the regulatory landscape

However, even if PE firms are able to overcome the challenges relating to the supply and application of alternative data, regulatory controls and compliance challenges may constitute another barrier to its use. Although typically less closely scrutinized than active managers investing solely in public markets, where market abuse and insider trading regulations heavily regulate access to company information, private equity managers are still heavily regulated entities and should anticipate the development of more stringent regulations in this relatively young field in the future.

Depending on the nature of the alternative data in question, it might raise questions of copyright, intellectual property, or confidentiality. Regulations such as the California Consumer Privacy Act (CCPA) and the EU’s General Data Protection Regulation (GDPR) create a potential minefield for how investment firms properly procure and store the more modern alternative data sources, such as from mobile apps and social media. PE managers more accustomed to focusing on SEC restrictions around fund marketing will need to reengineer their workflows to ensure compliance with unfamiliar regulatory requirements.

Given the many valuable potential use cases of alternative data in private equity, it is an inescapable conclusion that a shortage of technical and regulatory know-how is the principal barrier to managers adding this new string to their analytical bow. In the near term, a majority of PE firms will not realistically aim to build the machine learning or consumer data protection expertise required to navigate these challenges in-house. But if data vendors, technology providers, and fintech consultants can service this growing demand, we should expect to see a pronounced change in how the private equity industry makes its investment, portfolio management, and exit decisions.