Sustainable investing and data

Sustainable investing has undergone a steady evolution from niche market segment to a significant and integrated component of the broader investment landscape. According to Blackrock’s 2020 global investor survey, sustainable investments now represent a third of all assets under management (AUM), and respondents planned to double their ESG positions in the coming five years. This trend has been building momentum for more than a decade, and signs point to its continued acceleration.

Despite the size of the market segment and its rate of growth, standards for reporting on and tracking the ESG performance of investments have been slow to emerge.

Despite the size of the market segment and its rate of growth, standards for reporting on and tracking the ESG performance of investments have been slow to emerge. Many specialized ratings companies and data providers now exist, but there is no consensus around benchmarks, attributes, or what exactly to track. The vast majority of global ESG-related AUM remains under active management, forcing individual investors to rely on financial advisors to make sense of the fragmented data landscape and limited supply of suitable investments.

As demand and investor sophistication continue to grow in coming years, new standards and techniques are needed for financial institutions to raise the bar and more easily serve their customers. Firms today are faced with the rapid proliferation and fragmentation of data, much of which comes in an unstructured form requiring sophisticated techniques to leverage in analysis. Third party data sources are also only updated on a periodic basis, creating time lags that can negatively impact decision making and tracking, as well as mismatches between sources. Methodological differences and minimal regulatory guidance can also create significantly different classifications of the same groups, requiring analysts to consider and mediate multiple sources. Lastly, investors do not all share the same concerns and need better tools to assess potential investments and their portfolios without relying on pre-packaging in vehicles under active management.

Investors do not all share the same concerns and need better tools to assess potential investments and their portfolios without relying on pre-packaging in vehicles under active management.

Empowering users with AI

Lab49 is working with Databricks, the data and AI company, to pioneer new solutions to these problems. Databricks’ data driven ESG industry solution takes a novel approach to creating more timely analytics around ESG performance from publicly available sources.

Lab49 and Databricks have developed an end-to-end proof of concept for delivering analytics, created in the Databricks notebooks, with a high-quality user experience. The new solution enables less sophisticated investors or financial advisors to interact with the data and make informed decisions.

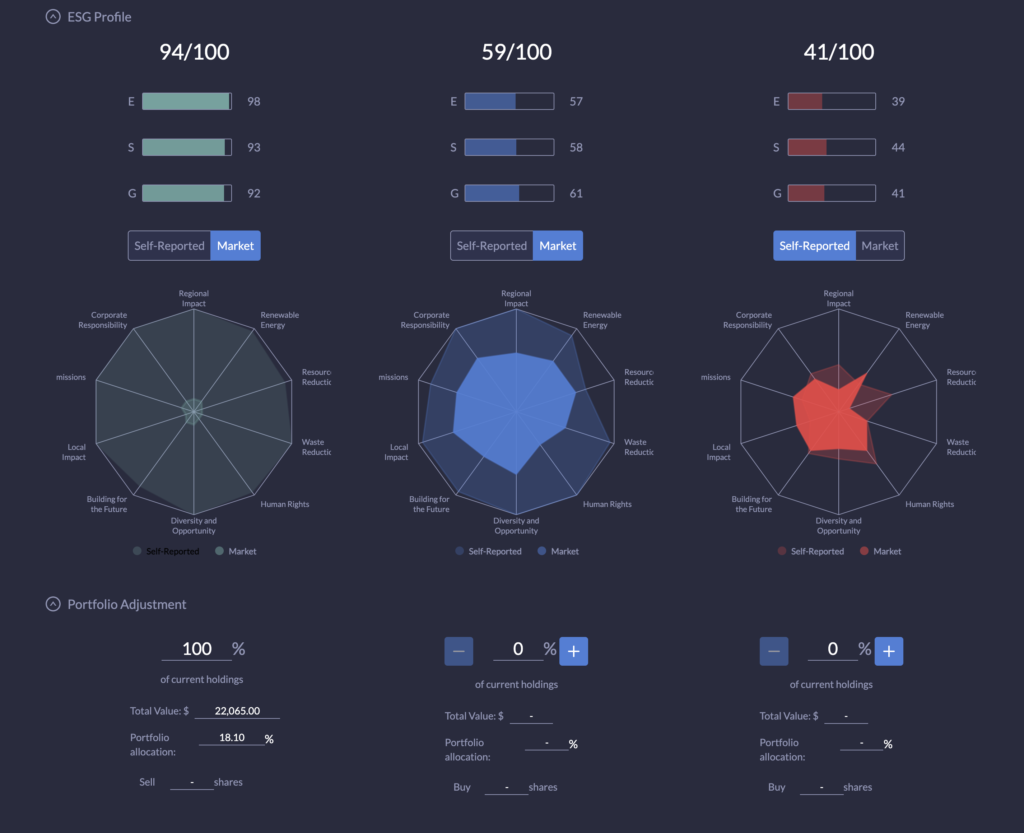

The Databricks solution gathers CSR reports from individual companies to measure self-reported ESG initiatives, combining them with publicly available media, aggregated from numerous sources, to measure the broader market’s view of the same companies. This is achieved via the application of Natural Language Processing (NLP) as well as Artificial Intelligence and Machine Learning techniques, and is available to review online here.

The combination of analytics from these two sources creates a rich data set for comparing the areas companies are choosing to put emphasis on publicly versus how the market perceives their behavior and the outcomes of their actions. In practice, this can be blended with a vast array of additional data sources including ESG ratings from third parties, derived from other alternative data sources, and, importantly, economic performance to drive investment decisions.

To illustrate how these analytics can be leveraged in the real-world, we created a wealth management portal designed for use by both individual investors and financial advisors for high net-worth investors. The portal provides tools for assessing the ESG and economic performance of an existing portfolio, including specifying individual preferences and concerns.

The portal also gives the investor the flexibility to work interactively with a financial advisor in real time to understand and address complexities flagged by the analytics, and how best to address within the context of the investor’s personal goals.

The ESG movement is here to stay, but in order to capitalize on the opportunity, tomorrow’s leading firms need to strategically invest in the appropriate capabilities and solutions today.

The novel solution demonstrates how financial services firms can improve their capabilities around data, analytics, and customer-facing applications to respond to clients’ evolving needs related to ESG and investing in general. The ESG movement is here to stay, but in order to capitalize on the opportunity, tomorrow’s leading firms need to strategically invest in the appropriate capabilities and solutions today.

Lab49 and Databricks will be showcasing the solution at the upcoming Sustainability Leadership Forum. To learn more about how Lab49 and Databricks can help your firm accelerate your ESG solution development and implementation strategy, register for the forum on March 10th here or contact us directly at sales@lab49.com.